Denied Claims Have Many Reasons to Consider

Sometimes the claim is denied because of the contract language of the plan that is found in the Policy Provision Manual of the patients policy. This information is the most difficult to get unless you are in network with the insurance company. This contract language will state that the policy excludes the procedure or denied service. Often the practice will appeal the claim with reasons the treatment should be paid. The insurance company is not disputing that the services were not good care just that the policy doesn’t cover the service due to a “plan exclusion.”

If this is the case the practice should contact the patient and have them contact their Employee Benefits Manager at their employer’s HR department. Many times, this Employee Benefits Manager can override a self-funded plan exclusion for this patient.

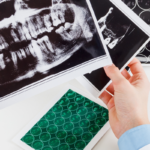

Other times the claim is denied because it lacks evidence necessary to support the procedure or “medical necessity”. Some of this evidence might be fractures or deep decay that is necessary to support the procedure of a crown. The x-ray or oral photo may not show the extent of the decay or a fractured cusp (broken away from the tooth) and therefore the insurance company will not cover the crown. The service must be a “covered benefit” under the policy to be appealed.

Now it will require a Second Review and you must have the proper documentation presented as “new information” or it will be kicked out with no payment. The additional information will include a precise but short narrative, clinical notes from the chart, any photos or drawings left out with the first submittal to show what was not obvious with the first submittal.

It is important to find out exactly what each insurance company requires in evidence to pay for the service being billed to avoid a Second Review(appeal) which can take as much as 60 to 90 days to get paid depending on the insurance company.

0 Comments