Cashflow and the Pandemic

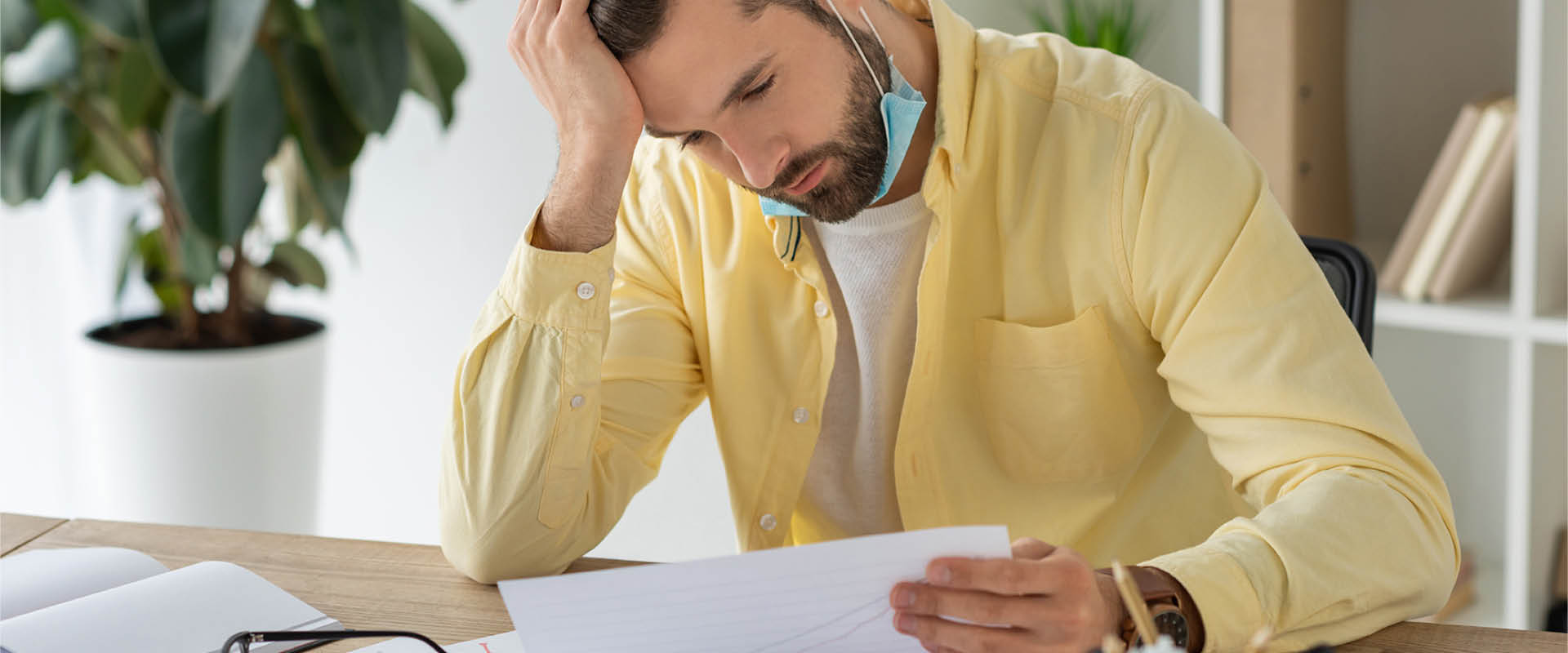

Dental practices rebounding from the pandemic’s effects are grateful when patients call and show up for appointments. This gratitude can result in lower collections because dentists and staff realize that many people have been laid off permanently, furloughed, or have less income to spread around. The patient record may show that they have insurance when, in fact, it has been canceled due to the change in employment status. Sometimes this critical information is overlooked because you want someone in the chair. Besides, the Business Coordinator’s reluctance to make firm financial arrangements may show empathy to the patient but spells disaster to the business.

“We want to increase production to make up for our shortfalls in the last few months. We are seeing more patients needing scaling and root planing, and we are performing the procedure and billing the insurance accordingly”, says one dental hygienist who is working full time in general practice.

“I have unsuccessful results getting the insurance to pay for the increase in scaling and root planing; there are delays and requests for information that are causing the patients to become angry,” said the Business Coordinator in the same practice.

When practice numbers are down, it can be frustrating to build the practice back up. The practice may seem busy, but if the collections don’t match the production, there is trouble paying the bills.

Developing a standard financial policy and collections protocols will clarify your payment expectations to the patient removing any conflicts regarding payments. When you have written policies, you’ll have a more steady cash flow and pay your expenses and your team. Patients want and need to know how they are supposed to pay. If they don’t receive the information from you directly and professionally, they will pay as they see fit.

Collecting money from patients isn’t easy and can produce anxiety.

Hire someone with the right skills and temperament and provide them with the proper training to ensure their success. Collection calls should never be aggressive. Instead, your Business Coordinator should work with patients to resolve issues so your practice can collect payment.

Your Business Coordinator must tract the Accounts Receivables and Unpaid Insurance Reports.

- Create an aged accounts receivable report once a month. The information should list every account with an outstanding balance and date of the last payment.

- The report must “age” the receivables showing the “current” column produced in the last 29 days not collected. Providing a breakdown of accounts that are 30, 60, and 90 days past due.

- Calculate all revenues that are over 90 days past due. 10% of your total accounts receivable is an acceptable amount.

- Observe the charges in the report’s “current” column. These are uncollected revenue produced in the past 29 days.

- A credit balance report will reveal a total that is added back to the total accounts receivable. Credit balances reflect overpayment or incorrect insurance payment posting.

Standardize Billing Systems: Implement electronic billing into your practice for convenience to the patient and quicker payments. Patients can pay their bills when suitable for them, and your team members can focus on other tasks.

Insurance claims aging report

Your Business Coordinator is trained to use the computer software to generate insurance estimates and let patients know their portion before treatment. It’s essential to tell patients this is an estimate that may need to be adjusted if their policy covers less than expected.

Transparent Financial Policies and Payment expectations: For a financial policy to work, it must be communicated to every patient. The system should be on your website and presented to the patients when the appointment is scheduled.

Evaluate your cash flow by calculating the numbers for net production and collections over the last 12 months. The percentage of accounts receivable over the previous 90 days, and the total monthly payments made to leases, loans, and business credit cards. From there, look at your average monthly payments to the lab, dental supplies, salaries, taxes and benefits, monthly facilities costs, and all the miscellaneous expenses that don’t seem like much until you add them up. Now you see where the money goes and why it is necessary to have a healthy daily cash flow.

Those 30-day, 60-day, and the despicable 90-day AR totals are red flag reminders that your money is still out there. Cleaning up the AR takes many hours, especially when you follow up on unpaid claims. Remember, individual insurance companies give you only a small window of opportunity to complete claim adjudication and receive payment.

To avoid unpaid claims, take steps to ensure the claim is filed the first time correctly. For instance, whether you verify insurance eligibility and benefits has a significant effect on cash flow. Be diligent and do the following:

- Verify insurance eligibility on all scheduled patients well ahead of their appointments.

- Verify covered benefits, maximums, history. Are there procedures that require pre-authorization?

- Are there procedures that have “wait” times before they are provided?

Even making the smallest error in this information will delay payment or cause a denial of payment.

Suppose your practice has experienced turnover, or because of the pandemic, you have a smaller team and don’t have consistent time to devote to cash flow systems. It is time to consider outsourcing. Insurance verification, insurance billing, claims follow-up, and patient portion collection must be completed daily to ensure healthy cash flow.

eAssist dental billing is prepared to handle the cash flow challenges facing all practices now more than ever. eAssist has the best, highly skilled insurance billers who become part of your team but are not subject to layoffs or turnover, and you don’t pay their taxes or benefits. Your cash flow will not be interrupted and be performed professionally and expertly daily. eAssists collect what you have rightfully earned.

0 Comments