What is dental practice accounting?

Dental practice accountants are crucial when running a dental practice because they assist with all things financial, and relieve the practice owner from the burden of line-item finances. Does your dental practice have an accountant? eAssist Dental Solutions offers several dental practice accounting options curated specifically to dental, orthodontic, and dental specialty offices. Let’s look at what dental practice accounting entails and how outsourcing to eAssist can give you the peace of mind you deserve.

What is dental practice accounting?

Dental practice accounting is general accounting services, but tailored to the special accounting needs of a dental practice. Dental Accountants can make sure all payments in your practice management software are verified and reconciled — including insurance checks & electronic-funds transfer (EFT) payments along with patient payments. Imagine the peace of mind you could have as a business owner knowing that your bank account and practice management software reflect the same numbers month after month.

Along with your daily accounts receivable, you also have daily expenditures that include marketing costs, vendor & supply costs, technology costs, and much more. A dental practice accountant will work alongside you to help set financial goals and budgets, and make sure you stay within those budgets for monthly and yearly expenditures.

Why is dental practice accounting important?

Did you know that insurance companies occasionally deposit funds into the wrong bank account? Did you know that staff responsible for posting payments may invert a number by mistake? It’s true, mistakes happen. But having a dental practice accountant as another set of eyes on your financials guarantees that human error mistakes both insurance companies and staff are found and reconciled immediately.

Reconciling your practice management software with your bank account is incredibly important to ensure that both insurance and patient payments are posted accurately. Insurance electronic-funds transfer (EFT) payments also need to be reconciled to ensure the payments were deposited timely and accurately.

Dental practice accounting is another layer of protection around your practice finances. So while the threat of embezzlement may never truly be eliminated, this added layer of protection discourages most employees from theft.

How can dental practice accounting help me?

Different dental practice accountants provide different services, but here are just a few of the services that eAssist dental accountants offer:

- Balance your dental practice checkbook

- Dental practice bill pay

- Office staff payroll

Having a dental practice accountant perform these tasks allows you to focus on the important areas of growth for your practice. Let’s take a look at what that could look like:

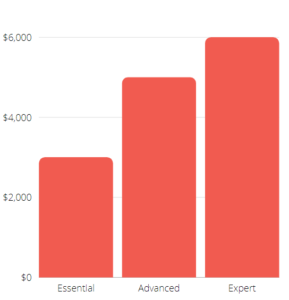

The median production for a dental practice is $500 per hour, with top dentists producing $800-1000 per hour. Trusting a dental practice accountant with the essential dental practice financial tasks means freeing up anywhere from 5-12 hours of time each month to see patients and focus on increasing production revenue. That means up to $6,000 or more in added production revenue month after month!

This type of growth every month is every practice owner’s dream. And while you are setting growth goals and generating more collectible revenue, you can breathe a sigh of relief that the time-consuming tasks of bookkeeping, payroll, and bill pay — just to name a few — are being handled by a trusted dental practice accountant.

At eAssist, we have incredibly knowledgeable dental accounting specialists that provide any and all of the services referenced in this blog post, and help you reach your financial goals for your dental practice. This is the peace of mind you have been looking for.

Dental accountants are not certified public accountants.

2 Comments